The Highland Park ISD Board of Trustees has unanimously approved calling for a tax-rate election that would increase teacher and staff compensation while still reducing HPISD property owners’ tax rates to a 5-year low. The election will be held Tuesday, November 2.

How did House Bill 3 impact school funding and staff compensation in HPISD?

- The state’s school funding formula, which causes approximately 66 cents of every local property tax dollar to be recaptured by the state, has historically made it difficult to provide increases in compensation at the same pace as other North Texas school districts. A landmark school funding law (House Bill 3-"HB3") passed by the Texas Legislature in 2019 increased school funding for all districts statewide, but HPISD received less as a percentage. While HPISD gave the largest salary increase in 11 years to teachers and staff in 2019, the district has not been able to keep pace with the increases in staff compensation, at all levels, that other North Texas school districts have been able to offer.

- HPISD’s average teacher salary now ranks 24th out of 25 comparison districts in North Texas and will likely fall further behind for the coming year.

- Additionally, HPISD is scheduled to lose approximately $3 million in state funding after 2023-2024, which will further impact funding disparities.

Did House Bill 3 provide HPISD any relief?

- House Bill 3 allocated more state-level funding towards education and, in turn, compressed local property tax rates. Per HB 3, HPISD's base tax rate will decrease 6.1 cents (per $100 of assessed property value) this school year versus the 2020-21 school year.

- At the same time, HB 3 has given HPISD voters local control by providing the opportunity to access up to four golden pennies in additional tax revenue that is not subject to State recapture and that, if approved by voters, will be solely dedicated to staff compensation.

What is the choice that the taxpayer has in this election?

- The election would authorize the use of 4 “golden pennies” (which are not subject to the state’s Recapture formula) from the tax rate.

- A majority vote for the golden pennies will decrease the tax rate by 2.1 cents per $100 of assessed property value and generate approximately $3.6 million to be used for staff compensation.

- A majority vote against the golden pennies will decrease the tax rate by 6.1 cents per $100 of assessed property value.

What is the tax impact?

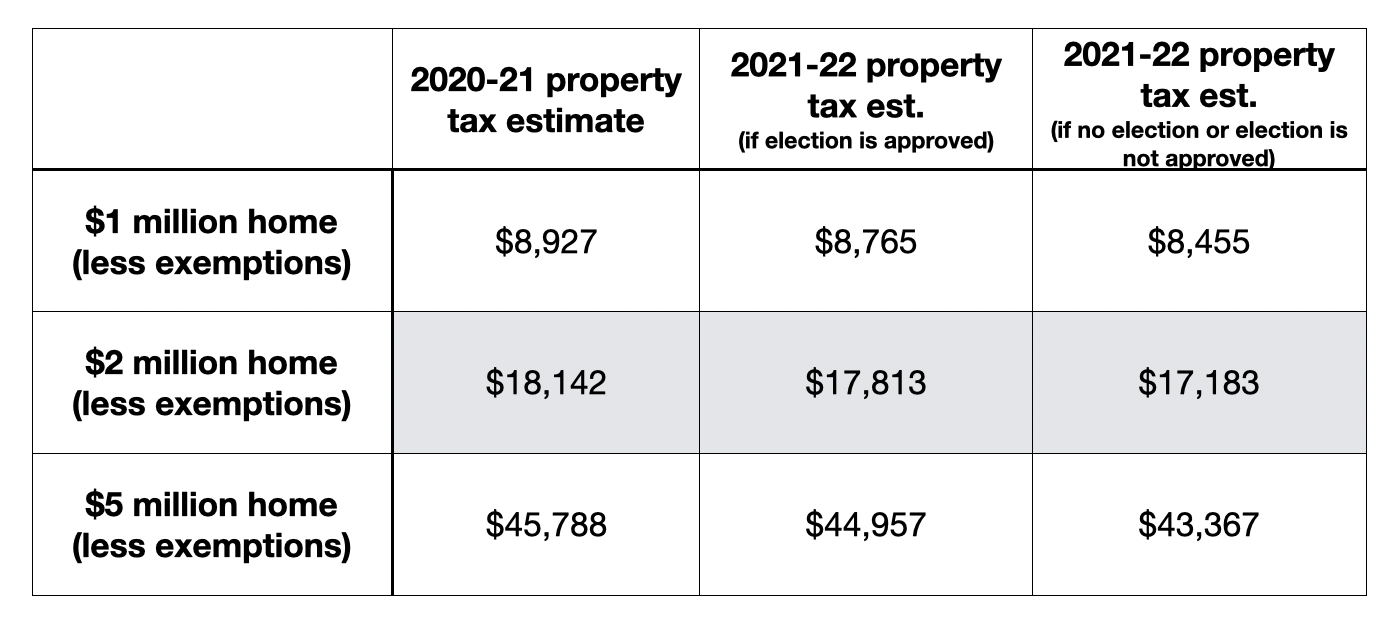

- The tax rate difference between the two options (2.1 cent decrease vs. 6.1 cent decrease) is projected to be $310 annually (less than $26 per month) on a home with a taxable value of $1 million.

- Property owners 65 and older, who have a homestead tax ceiling, would experience no change to their taxes due to the election.

This table shows estimates for the impact on property taxes on homes valued at $1 million, $2 million and $5 million respectively.

What is HPISD's fiduciary track record?

- HPISD has been a careful steward of taxpayer dollars. The district’s most recent external audits have been the highest rated with unmodified opinions.

- The district received the highest financial integrity rating (A) from the state of Texas in 2020, a Transparency Star Award from the State Comptroller, a certificate of Achievement of Excellence in Financial Reporting from GFOA (Government Finance Officers Association) and the Certificate of Excellence in Financial Reporting from ASBO (Association of School Business Officials).

Election Day is Tuesday, November 2. Everyone is encouraged to get out and vote.

To see a recent PowerPoint about the election, go here.