The HPISD Board of Trustees is examining an option to call for a voter-approval tax rate election (VATRE) that would be held in November. If approved by voters, it would raise additional revenue to increase teacher and staff compensation while still reducing homeowners’ property tax rates to a five-year low. The board has scheduled a meeting at 5:30 p.m. Monday, Aug. 16 in the Legacy Ballroom of the HPISD Multi-Use Building to make the final decision on whether to call for an election.

A landmark school funding law passed by the Texas Legislature in 2019, HB3, provided more funding to the majority of school districts statewide. HPISD, however, received less as a percentage compared to other districts, and a portion of the funding it did receive is only temporary. Per HB3, HPISD is scheduled to lose $3 million in funding in 2023-24, which will make the funding disparity even greater. As a result, HPISD has not been able to keep pace with the increases in staff compensation that other North Texas districts have been able to offer.

HB3, however, will decrease property tax rates to a five-year low in HPISD, including a projected 6.1 cent (per $100 of assessed value) decrease this school year versus the 2020-21 school year. At the same time, the law has given HPISD voters the opportunity to access more local property tax revenue to spend on district needs, such as staff compensation, which, for HPISD, is among the lowest in North Texas school districts. If approved by voters, the property tax rate in 2021-22 would be reduced by 2.1 cents (per $100 of assessed value), which would still be at the lowest level in five years.

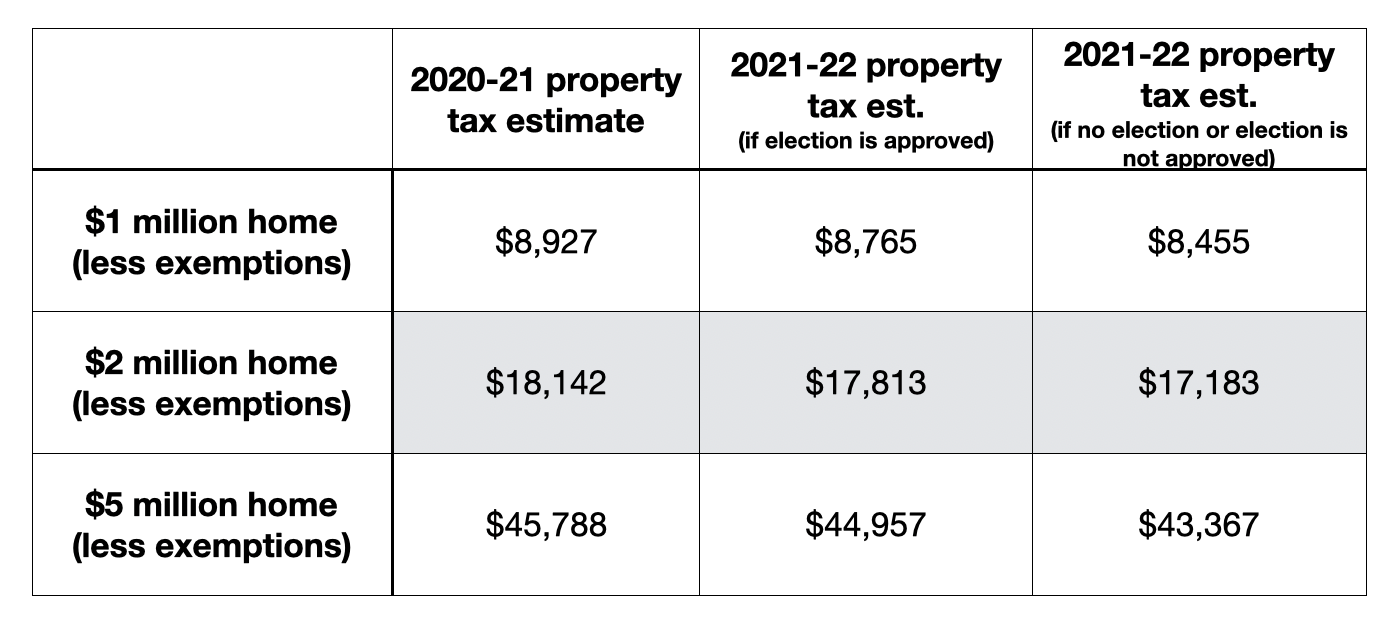

The election, which would take place on November 2, 2021, would authorize the use of four “golden pennies” (not subject to the state’s recapture formula) to be used exclusively for increased staff compensation. The difference between the two options (2.1 cent decrease vs. 6.1 cent decrease) is projected to be $310 annually on a home with a taxable value of $1 million. Property owners 65 and older, who have a homestead tax ceiling, would experience no change to their taxes due to the election.

This table shows estimates for the impact on property taxes on homes valued at $1 million, $2 million and $5 million respectively.

“The decrease in property tax rates presents a unique opportunity for HPISD taxpayers to raise more local revenue while realizing a decrease in the tax rate,” Trustee and Finance Committee Chair Edward Herring said. “The incremental new revenue would not be subject to recapture by the state; rather, it would stay right here in HPISD to help recruit and retain our quality staff.”

The HPISD Finance Committee, which is comprised of local citizens and three HPISD trustees, has been evaluating the possibility of a voter-approval tax rate election (VATRE) option as part of the 2021-22 budget process. HPISD faces three challenges: 1) district teachers are among the lowest paid in the region, 2) district students are among the least funded in North Texas, and 3) state funding is going to drop by approximately $3 million in three years when the district no longer receives “formula transition grants” from the state (which were provided over a five-year period by HB3).

Trustees who serve on the Finance Committee presented preliminary information to their board colleagues during a virtual workshop on July 13, which included a recommendation to use the projected $3.6 million to increase compensation for teachers and staff. Trustees discussed the option in more detail during a work session held on Aug. 3. Both the workshop and work session were open to community members.

Currently, HPISD’s average teacher salary is 24th out of 25 comparison districts in North Texas and will likely fall further behind for the coming year. That position near the bottom of nearby districts is consistent for other staff positions as well. Feedback following recent hiring efforts indicates that compensation is the number one reason applicants decline job offers from HPISD, making it more difficult to fill vacancies. During a survey of district parents conducted in June 2021, attracting and retaining quality teachers was listed as the second most important issue facing the district (preparing students for college and careers was #1).

“We expect HPISD staff to be the best of the best yet they are underpaid compared to their colleagues in neighboring school districts, and we have had limited options to address this disparity until now,” Superintendent Dr. Tom Trigg said. “I am thankful that the Board of Trustees is carefully considering this option.”

The state’s school funding formula, which causes approximately 66 cents of every local property tax dollar to be recaptured by the state, has historically made it difficult to provide increases in compensation at the same pace as other North Texas school districts.

HPISD has been a careful steward of taxpayer dollars and now faces decreased funding due to HB3. The district’s most recent external audits have been the highest rated with unmodified opinions. The district received the highest financial integrity rating (A) from the state of Texas in 2020, a Transparency Star Award from the State Comptroller, a certificate of Achievement of Excellence in Financial Reporting from GFOA (Government Finance Officers Association) and the Certificate of Excellence in Financial Reporting from ASBO (Association of School Business Officials).