HB3 Overview

Below is a summary of HB3 and its impact on school funding in HPISD.

- HB3 was a landmark school funding law passed by the Texas Legislature in 2019 that provided more state-level funding for education statewide, which allowed property tax rates to be lowered through compression.

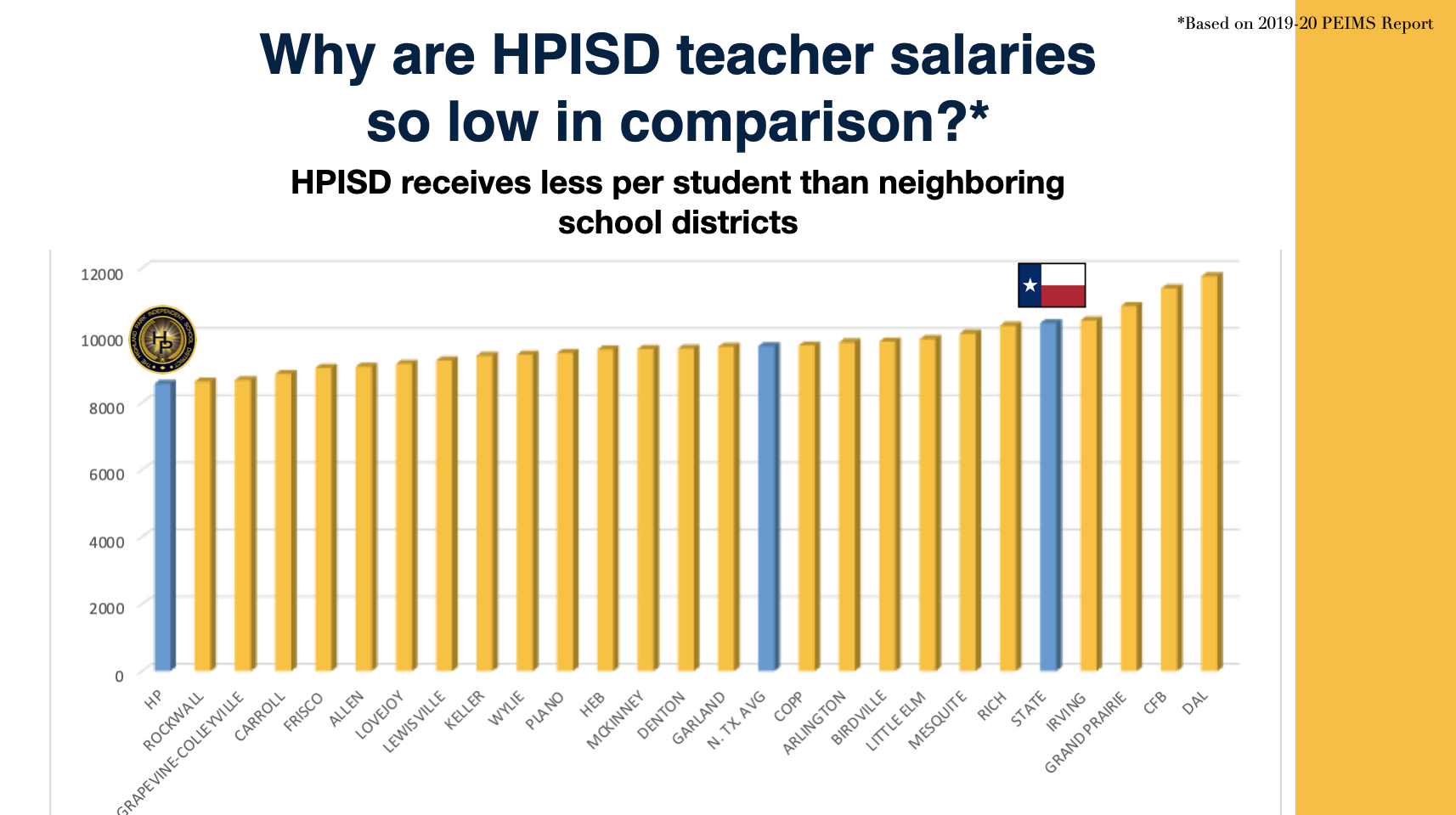

- While the vast majority of school districts received more funding from the per student allocation than they had prior to HB3, HPISD received less as a percentage.

- Because of this funding disparity, HPISD did receive a temporary five-year transition grant that will end after the 2023-24 school year.

- While the grant has been helpful, it has not been enough for HPISD to be able to keep pace with the increases in staff compensation that other North Texas districts have been able to offer.

- Once HPISD loses this $3 million transition grant after 2023-2024, the funding disparity will be even greater, and HPISD staff compensation most likely will fall further behind.

- Due to the tax rate compression mandated by HB3 (explained above), HPISD's property tax rate is scheduled to decrease in 2021-22 by 6.1 cents (per $100 of assessed value) compared to 2020-21 to the lowest level in five years.

- HB3, however, has given HPISD voters the opportunity to access four golden pennies on its tax rate and KEEP more local property tax revenue to spend on district needs, such as staff compensation, which, for HPISD, is among the lowest in North Texas school districts.

- If approved by voters, the property tax rate in 2021-2022 would be reduced by 2.1 cents (per $100 of assessed value), instead of the projected 6.1 cents, which would still be at the lowest tax rate in five years.